Bureau Recommends: FSA investigates ‘rogue’ traders

The Bureau recommends a piece by the Wall Street Journal, which has looked into rogue traders and reports that UK financial regulators are examining multiple possible cases of unauthorised trading within London-based banks.

From the Journal’s investigation it seems rogue trading is a lot more widespread than the banks would like us to believe.

While the financial services industry describes the couple of well publicised cases as isolated incidents, an unnamed source told the Journal that the Financial Services Authority is building cases against individuals suspected of improper trading, and is considering bringing cases against institutions that failed to prevent the trades.

A senior FSA official who recently departed the institution said: ‘These aren’t isolated cases.’

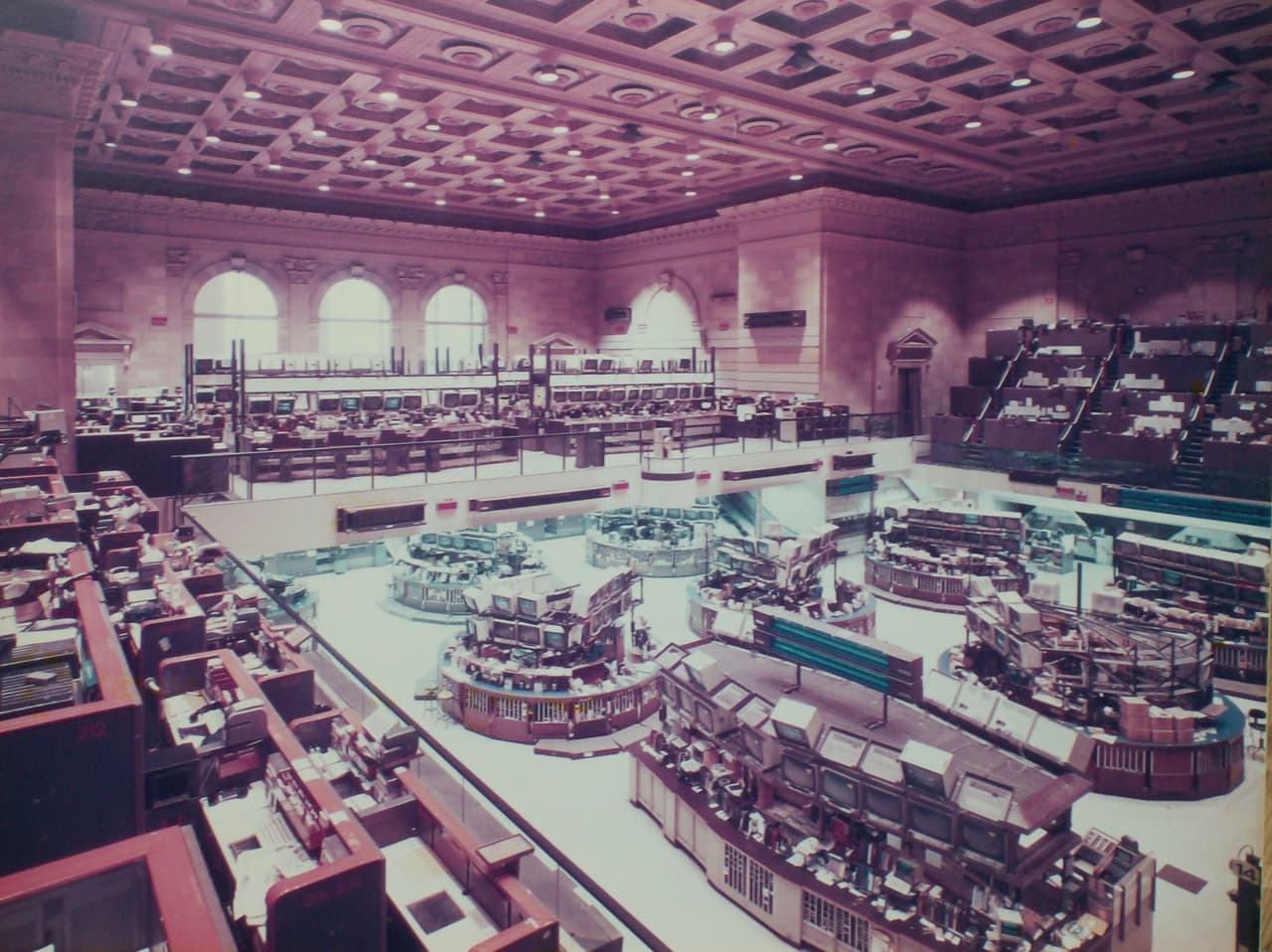

At least three of the cases under investigation are said to involve individuals who moved to the banks’ trading floor afters spending time in so-called ‘back offices’, where they handled accounting, confirmed trades and made payments. Both Mr Adoboli, implicated in the recent UBS case, and the trader responsible for a 2008 rogue-trading scandal at French bank Société Générale SA had similar career paths.

The Journal writes that the current investigations, as well as a handful of less serious cases over the last few years, illustrate that the problem of unauthorised trading occurs more often than is generally realised.

It also raises questions about the abilities of banks to regulate their own traders. Rob Moulton, a partner at London-based law firm Ashurst LLP, said: ‘It does make you wonder how it could be so difficult to pick these up.’

A UBS spokesman declined to comment.

To read the full article (paywall), click here.

The Bureau has previously reported on the risks of highly-complicated trades such as Delta One Financing. For analysis from the Bureau, click here.