Priority investors made at least £98m selling Royal Mail shares in its first six days of trading

Last October the government, advised by Lazard & Co, allocated 22% of new shares in Royal Mail to 16 priority investors.

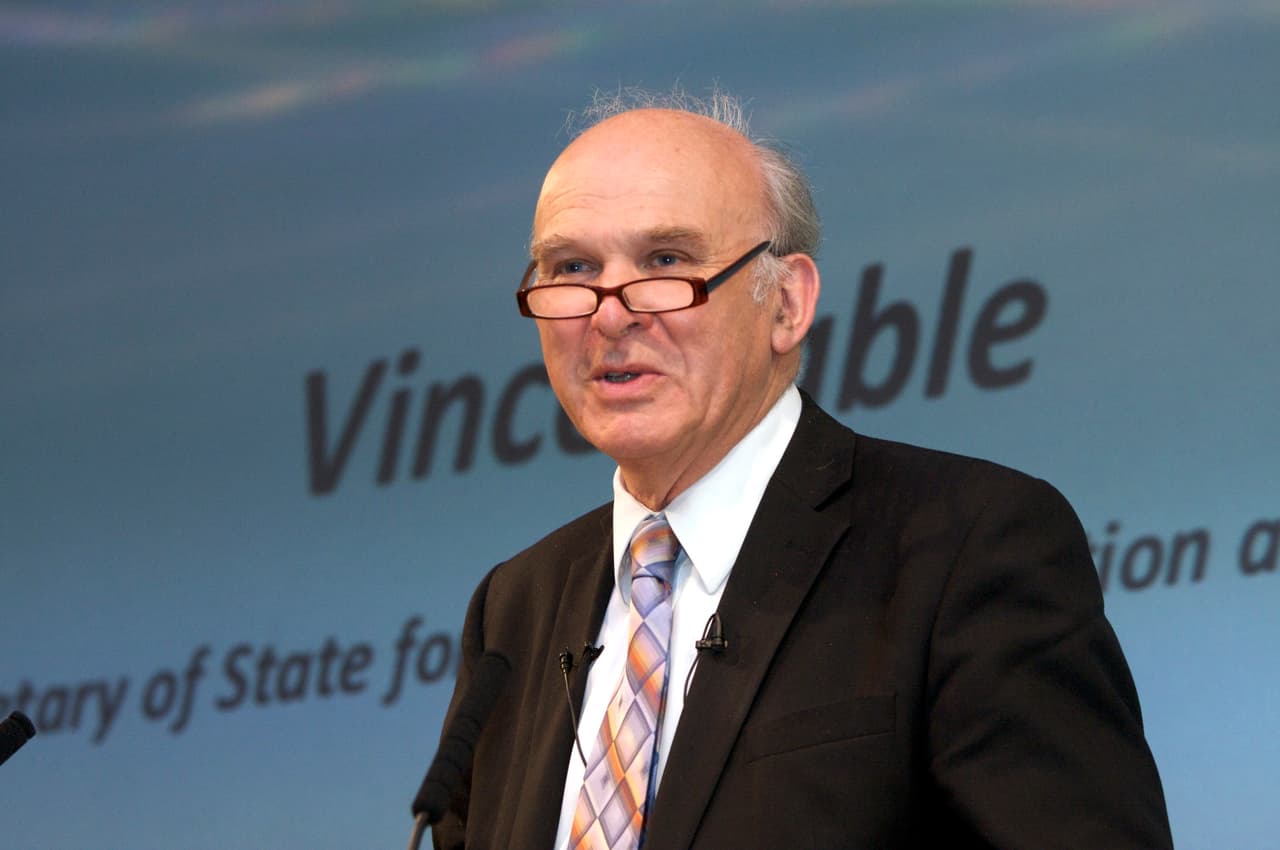

Vince Cable stated that these 16 institutions would be long-term investors in the UK’s national delivery business. Royal Mail shares were over 23 times oversubscribed prior to flotation and shares increased 51% from the IPO price after its first full week of trading.

Now analysis of the Royal Mail shareholder register by the Bureau of Investigative Journalism shows that priority investors sold 43% of their 228 million shares during the first six days of Royal Mail’s admission onto the London Stock Exchange.

This made the 12 priority investors that sold some or all of their holdings, at least £98m.

The priority investor which sold the most Royal Mail shares after the end of its first week was Capital Group – one of the world’s largest investment firms with $1.2 trillion under management.

Capital Group was granted the biggest allocation in Royal Mail prior to the IPO. It reduced its 22.6m share allocation to just 3m in the week following the start of full trading.

The sale of shares by Capital Group made a profit of between £26.5m and £39m.

The second highest net profit on the sale of Royal Mail shares was made by another US investment manager, BlackRock. The firm’s various funds sold holdings at a profit of between £12.4m and £27.3m. BlackRock subsequently bought Royal Mail shares through its index tracker funds.

Profits from sales of shares in Royal Mail, say many of the institutions, flow to clients rather than the fund managers themselves. However, some investors co-invest and secure significant shares in profits from the funds they manage.

Sold out completely

The shareholder register indicates that two companies sold all of their holdings in Royal Mail within the first week of trading.

One of these companies is Lazard Asset Management, which is the investment arm of Lazard whose advisory arm advised the government on the share sale.

At a recent parliamentary committee hearing, the head of UK equities at Lazard Asset Management, Alan Custis, admitted that the firm’s Royal Mail holding was sold for a profit of £8.4m.

Related story: Lazard Asset Management was a Royal Mail priority investor and made £8m profit in one week

The other company that appears to have sold all of its shares in the first days of trading was Schroders, which had an initial allocation of 13.5m shares.

Standard Life, the UK pension and investment manager and another priority investor, did not sell any shares during the first week of trading. However, as the Bureau has previously revealed, the company subsequently sold some of its holding making a minimum profit of £25.8m on its Royal Mail shares between November 2013 and March 2014.

Lansdowne Partners, the hedge fund controlled by Sir Paul Ruddock according to its most recent accounts filed at Companies House, sold a tiny amount of its 19 million shares at the end of the first week of Royal Mail share trading.

Adrian Bailey MP, the chair of the Business Innovation and Skills Committee, said: ‘This does not meet the Minister’s declared commitment that control of the Royal Mail would be in the hands of responsible long term investors. The allocation of shares adopted by the ministers has exposed their promises as naïve or downright misleading. The city has acted true to type – the financial institutions have made huge profits whilst the taxpayer has lost out.’

1) To estimate the profits made on the sale of Royal Mail shares, the Bureau relied on three publicly available sources. These are a letter from Vince Cable stating precise allocations made to priority investors together with Royal Mail’s shareholder registers of beneficial interest on both 15 and 23 October. This is equivalent to six days of trading.

2) This has allowed us to calculate profits across two time bands. These are between Friday October 11 when conditional trading of Royal Mail shares started and the close of trading on Tuesday 15 October – the end of Royal Mail’s first day as a stock market listed company and the first time a shareholder of beneficial interest in Royal Mail shares was recorded. This process was repeated between October 16 and close of trading on October 23.

3) We identified the lowest point shares traded during the two date ranges as well as the highest.

4) The two profit ranges were then combined to give an overall profit range.

5) By dividing the calculation into two periods we have weighted the overall profit range depending on when shares were sold to reflect variations in share price. We feel this is a more accurate representation of the profits made on the sale of Royal Mail shares.

6) The 12 priority investors that sold some or all of their shares could have made profits as much as £186m if they sold their shares when prices peaked within the two time bands.

7) As reliable data was not available for Threadneedle, we used a graph in the National Audit Office report to estimate its holding. The graph shows that it sold 14% of its shares in ‘the first weeks of trading’. This allowed us to calculate a holding of 16,700,000 shares following the sale. Please also note that the shareholder register indicates that JP Morgan bought just over 300,000 shares between the 15 and 23 of October.

Related story: Royal Mail: did the government and bankers short-change Britain by £750m?

Main image via Shutterstock