From the UK to Dubai: On the trail of the "fraud of the century"

A British fraudster who stole millions of euros of taxpayers’ money had links to a network based in north west England suspected of large scale criminal activity for more than two decades.

Leaked documents reveal Imran Yakub Ahmed, 45, from Preston, who now lives a life of luxury in Dubai, was under investigation by the UK authorities as early as 1998 over concerns about his links with members of the suspected network. A decade later he would go on to be involved in what has been described as “the fraud of the century”.

He was convicted by an Italian court in 2017 for his participation in a criminal conspiracy to steal VAT.

The network was based in the north west of England and was under investigation for years. Fraud investigators were concerned about a “highly-organised and sophisticated group” suspected of running large tax scams in the UK. Secret MI5 files raised concerns that some of the money might have ended up in the hands of terrorists though it is not suggested members of the ring had knowledge of this.

The Bureau of Investigative Journalism has worked with the Sunday Times, the German non-profit Correctiv and 35 European newsrooms to review thousands of leaked documents from HMRC and prosecutors from across Europe, in a project called Grand Theft Europe.

The files reveal how investigators concluded that individuals had stolen vast sums of taxpayers’ money through a series of frauds across Europe.

Ahmed and another Preston man, Mohsin Salya, 40, are detailed in these files. They were both convicted for separate conspiracies to steal hundreds of millions from European tax authorities in the space of just two years.

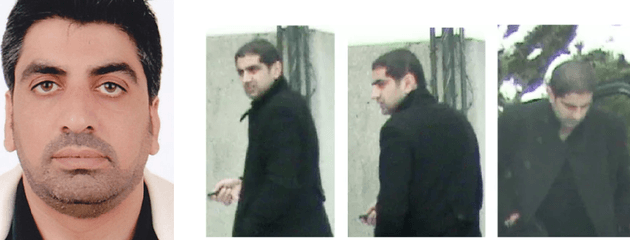

Left: Imran Yakub Ahmed. Right: Pictures of Mohsin Salya released when he was wanted by German police

Left: Imran Yakub Ahmed. Right: Pictures of Mohsin Salya released when he was wanted by German police

The frauds took advantage of a scheme that was intended to reward companies for reducing carbon dioxide emissions. Companies could trade certificates - known as carbon credits - for profit. The fraudsters imported the certificates without paying VAT, and then charged VAT when they sold them, ultimately to major banks. The banks then reclaimed hundreds of millions of tax from British and European countries that had never been paid.

Investigators concluded that fraudsters had set up an extensive series of sham companies, often fronted by desperate individuals, including a drug addict and a person in debt, to evade detection. Many individuals have been prosecuted for their roles in these frauds across Europe.

Following six years of investigation and several trials in Germany, Deutsche Bank repaid €145m (£128m) of lost VAT to the German state and one of its traders was jailed for his involvement in the fraud. The banks, critics say, were key in allowing fraudsters to steal vast sums of money.

British authorities are still trying to recoup some of the money stolen in the UK - estimated to be £300m - in court cases against major banks, the Bureau reported recently.

Leaked files reveal Ahmed is believed to have bought two floors of the world's tallest building the Burj Khalifa in Dubai

Alamy

Leaked files reveal Ahmed is believed to have bought two floors of the world's tallest building the Burj Khalifa in Dubai

Alamy

The Italian connection

Ahmed was convicted of involvement in one of these VAT frauds in Italy, for which he was given a suspended sentence. He is now also under investigation in Germany for a similar matter but denies wrongdoing. He lives as a free man in Dubai’s answer to Beverly Hills. Leaked files reveal he’s believed to have bought two floors of the Burj Khalifa, the world’s tallest building, and had business interests with an Emirati sheikh.

He still runs a multi-million pound property portfolio in the UK including retail centres in Preston and Salford, and at one time he owned at least 20 houses in Preston and Dewsbury. HMRC valued his known assets at more than £180m in 2011 but believed this to be an underestimation of his true wealth.

Mohsin Salya

Mohsin Salya was sentenced to over three years in jail for a similar offence in Germany in 2016, but now lives in Dubai, where leaked property data from the same year showed he owned at least three apartments. Pictures on his Instagram account show him driving a car with a custom designed Hermès interior and sitting on the top of a brand new Cadillac SUV.

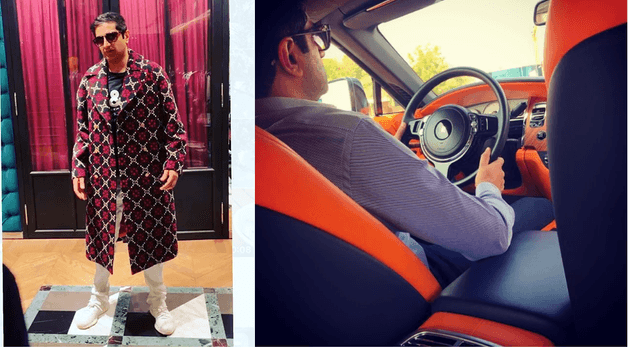

Left: Mohsin Salya Right: Mr Salya at the wheel of a car with a custom Hermès interior

Left: Mohsin Salya Right: Mr Salya at the wheel of a car with a custom Hermès interior

Uncovering the network

For the first time, the Bureau can reveal that these individuals had previous links with members of a network operating in the north west of England.

In the 1990s HMRC investigators began to raise concerns that a number of individuals suspected of fraud might be linked. They believed they might be running a number of coordinated scams in the North West’s manufacturing industry.

They were suspected of benefits, car insurance and national insurance scams - employing extra staff “all of whom were ghosts claiming benefits and having car crashes.”

The leaked files also detail an alleged £1m bonus believed to have been paid to some company directors in the form of gold coins which were never declared as income.

Terror finance questions

As they dug deeper, concerns only grew further as secret MI5 intelligence led them to suspect that some of the money gained through the frauds may have ultimately ended up in the hands of terrorists. It is not suggested Ahmed or Salya had any knowledge of this.

HMRC officers surveilling factories in the area reported seeing a hook-handed man bussing workers into factories for the manufacture of counterfeit goods.

HMRC did not realise at the time that this man was in fact the radical Islamist cleric Abu Hamza and were not aware of his links to terror. In 2006 Hamza was sent to prison in the UK for incitement to murder and in 2015 was handed a life sentence in the US for terror-related offences.

No members of the network have ever been charged with terror-related offences.

Ahmed was included in an HMRC investigation into the criminal network which did not result in charges against him. He has never been charged in the UK.

Ahmed says he has never been involved in an organised crime group and has never been involved in any fraud whatsoever in the UK.

In a written response Ahmed’s lawyers said: “Imran Ahmed strenuously denies all allegations that he has ever been involved in the funding of terrorism. Additionally Mr Ahmed has never been charged or convicted with any matters relating to terrorism. Furthermore Mr Ahmed has never received a caution or been convicted of any offences in the UK nor has he been convicted of any offences in Germany.”

Mohsin Salya also denies any links to terrorism or funding terrorism either directly or indirectly.

Suspected mobile phone fraud

In the early 2000s Ahmed set up a British company which started importing large volumes of mobile phones in what investigators suspected was a VAT fraud involving companies in Germany and Denmark.

Officers documented money leaving the UK and passing via a Norwegian businessman before being transferred to Pakistan, Hong Kong and Dubai. The businessman was later convicted of money laundering. Mr Ahmed denies knowing the businessman or even ever meeting him.

An HMRC official recommended a criminal investigation, raising concerns about a “highly organised and sophisticated” group of individuals whom it was believed had stolen £100m of VAT in a 15-month period. The files show that despite several years of investigation no action was taken. This was put down to a “lack of resources” and the “complexity” of the case.

Meanwhile in Germany prosecutors began investigating a separate €200m VAT fraud that took place between 2003 and 2005. Hundreds of officers raided 56 addresses across Germany, Britain, the Netherlands, Norway and Spain. Ahmed’s company was investigated as part of these operations but he has never been prosecuted in Germany.

By 2010, Ahmed was living in Dubai, and his office in the emirate became the base from which he masterminded a multimillion pound VAT fraud against the Italian authorities, leaked documents from the Milan public prosecutor’s office show.

Ahmed recruited a British man who had been working in property in Dubai to set up and manage an energy company in Italy selling carbon credits. The Briton later told Italian investigators he had no idea the company was part of a VAT scam and described Ahmed as “very friendly and kind” and “a good-looking man who seemed cut out for business”.

The hotel at Bolton Wanderers ground where Ahmed reserved a room

Alamy

The hotel at Bolton Wanderers ground where Ahmed reserved a room

Alamy

In November 2010, Ahmed was travelling from Dubai to Bolton in the north west of England, where he had a penthouse suite booked at a hotel in Bolton Wanderers’ football stadium. He was arrested for suspected money laundering by Greater Manchester Police and four mobile phones and a memory stick were seized, but he was released without charge and returned to Dubai.

In Italy prosecutors were investigating a complex carbon credits VAT fraud. Within six months of his arrest in Manchester these investigators asked the British authorities for judicial assistance and were given all the information seized including all the data found on his phones.

Conviction for tax fraud

This investigation led to his first trial. He never appeared in court to face the charges but in 2017 he was handed a two-year suspended sentence for tax fraud. He was ordered to pay €1m and the authorities seized another €3m from his company. They could further confiscate up to €79m of his assets, although it is unknown how much they have recovered.

And while Ahmed was stealing millions from Italian taxpayers, Salya was running another carbon credit fraud in Germany.

Photo posted by Mohsin Salya this week of him sitting on the roof of a brand new Cadillac

Photo posted by Mohsin Salya this week of him sitting on the roof of a brand new Cadillac

Salya also had ties to the North West’s manufacturing industry and was suspected by investigators of links to individuals believed to be engaged in fraud in the area in the early 2000s. His company, Continental Claims Consultants, was amongst those targeted by HMRC investigators as they continued to surveil and investigate the network.

He was banned in 2004 from acting as a company director for 14 years - almost the maximum penalty - after his car insurance company went into liquidation owing more than half a million pounds in VAT.

Salya strenuously denies any involvement in an organised criminal network and also says he has no connection to Ahmed.

By 2009 he had left his hometown of Preston and was involved in a group of sham companies in Germany. These were at the heart of a fraud that imported carbon credits from overseas and eventually passed them onto Deutsche Bank’s Frankfurt office, which reclaimed the fraudulent VAT which had never been paid.

Salya handed himself in and was sentenced to three years and three months by a German court in 2016. He served half his sentence and now lives in Dubai, seemingly surrounded by wealth.

Header image: Dubai skyline at dawn Urbanmyth / Alamy Stock Photo