Predatory businesses profit off personal debts

A murky world of middlemen is pushing people towards IVAs, a debt solution that can leave some worse off

After her marriage broke down in February 2021, Anastasija Rimdžienė found herself with four children and a mounting pile of debt. As her youngest approached their first birthday, her maternity pay ended; she survived on child benefit. Worried about what would happen to her family, she said she applied for universal credit and started to look for help online. “I was really stressed because of the family situation. I was scared, I had no financial income at that moment,” she said.

A friend suggested she might be able to clear some of her £5,000 debt by entering into a form of personal insolvency called an individual voluntary arrangement (IVA). These legally binding agreements with creditors let a person pay an agreed monthly amount over a period of usually five or six years. At the end, as long as the agreement hasn’t been broken, any remaining debts are written off.

It seemed like a lifeline to Rimdžienė. Instead, she was left hundreds of pounds worse off and with bailiffs at the door.

Unlike other personal insolvency options, there is big money to be made from IVAs – money that offers an incentive for rogue companies to steer people towards an IVA, even when it’s not the right option.

A TBIJ investigation with Channel 4 news has revealed the IVA industry to be a wild west rife with misinformation, hidden fees and murky advertising tactics, where poorly regulated middlemen can exploit desperate people in return for referral fees of £900. Some have even gone so far as to impersonate a genuine debt relief charity in their bid to attract clients.

Anastasija Rimdžienė, who has four children, struggled with debts after her marriage broke down

Gavin Wallace for TBIJ

Anastasija Rimdžienė, who has four children, struggled with debts after her marriage broke down

Gavin Wallace for TBIJ

More people than ever before are entering into IVAs and, with the cost of living crisis deepening, the charity Citizens Advice fears more will be forced into debt crises this year.

To find out about the quality of advice being handed out by these companies, TBIJ posed as two hypothetical women, “Hannah” and “Sarah”, and started making phone calls.

Both “Hannah” and “Sarah’s” situations are loosely based on real people struggling with debt who have contacted Citizens Advice for help. “Hannah’s” income is largely made up of disability benefits and “Sarah” is an unemployed single mother receiving universal credit. Both survive on very tight budgets. Citizens Advice said both could be left in a worse situation by an IVA.

Each profile was used to contact 10 referral services, which put people in touch with IVA providers. This resulted in 20 conversations with various companies – either with referrers who called us back or other linked companies replying to our enquiries.

Many of the calls followed the same lines. After running through details of the debts, TBIJ was asked leading questions like: “If you could get them [the debts] all ideally on the one payment, stop the pressure, would that help you?”

In another call, it was suggested that “Hannah” could cut back on her outgoings in order to afford an IVA. “It depends whether or not you feel it is sensible to tighten your belt,” she was told.

Across those 20 detailed conversations, which sometimes lasted up to an hour and went into intimate detail about either woman’s lifestyle and spending habits, 12 representatives said that either “Hannah” or “Sarah” were suitable for an IVA. This is despite an industry protocol stating that an IVA is very unlikely to be the right solution for a consumer whose income is solely made up of benefits.

“I don’t want to take money off of you, or take food out of your daughter’s mouth – I would not be able to sleep if that was the case,” Sarah was told shortly after the adviser ruled out an alternative solution that would have saved her money. She was then told an IVA could be suitable.

Almost half of the companies TBIJ spoke to provided information that was either incorrect or could be potentially harmful. This included:

Call handlers advocating for an IVA over other solutions that could have saved “Hannah” or “Sarah” thousands of pounds.

Income and expenditure figures being manipulated to make them fit the criteria for an IVA.

Companies providing misleading information such as describing IVAs as a “government help scheme” or claiming that bailiffs and debt collectors could be stopped instantly.

Advisers downplaying or omitting the downsides of an IVA.

TBIJ also called insolvency companies directly. Although an IVA was only presented as a suitable solution in two of these seven calls, the information and advice provided was still inconsistent.

Bailiffs at the door

Rimdžienė was drawn in by a website called Mums in Debt. This kind of specific targeting is fairly common – other similar websites include Mums with Debt, Women Dealing with Debt and Debt Daddy, to name just a few.

“That name of the company makes you feel safe straight away, that you’re not alone,” Rimdžienė said.

Her initial inquiry led to a call from another company called Debt Clear UK. “There was a very nice man talking to me, explaining that I deserve a better life and [said] if I get rid of all my debts I will be able to travel with my children. They made me feel like my life would change,” she said.

The call handler ran through an income and expenditure form with her but, she said, added figures that were not accurate reflections of her spending. Before the company made its referral to an IVA provider, Rimdžienė said he told her to “say yes” if asked whether the figures were correct.

Her case was then referred to an IVA company and it was agreed that she would make a monthly payment of £80. During an IVA, creditors should freeze interest, but after months of paying into the agreement, Rimdžienė opened the door to a bailiff chasing an old council tax debt.

“I had the baby in my hands and I was crying. The only thing that stopped him coming in was that I showed him the [IVA company’s] contract.”

When bailiffs contacted her again, she became concerned about the IVA and decided to stop making payments when calls and emails to the IVA company failed to reassure her. The agreement was terminated and the consequences dire. Despite paying almost £1,000 towards the IVA, just £233 had been knocked off her debt.

Debt Clear UK has since been wound up but some of its employees have gone on to work for a similar but separate company called UK Debt Clear. Sean Boal, director of UK Debt Clear, told us it buys leads from Mums in Debt and others but then has a thorough conversation with clients before referring them to a debt solution. He told us if there was evidence of wrongdoing by his staff it would lead to disciplinary action because he “knows the struggles of debt” and “how wrong advice can hurt people”.

The IVA company Rimdžienė dealt with told TBIJ through its lawyers that it could not comment on the details of her case due to data protection, but confirmed it does not give financial advice and only works with financial advisers who are regulated by the Financial Conduct Authority (FCA). It expressed concern that it could have been misled by Rimdžienė about her true financial situation.

IVA providers typically add fees of up to £4,000 when selling an agreement and, during the initial stages of the deal, paying off fees is often prioritised over the actual debt. If an IVA is terminated early, the remaining amount is due in full. As Rimdžienė found out, this sum can sometimes be only slightly less than before the deal was made, despite months or years of payments.

Although up to 30% of IVAs end in failure, the risks of ending the agreement early were rarely discussed by the companies TBIJ spoke to.

In Rimdžienė’s case, £720 of the £953 she paid into the IVA had been swallowed up by fees. With proper advice she could have applied for a debt relief order, another form of personal insolvency for people on very low incomes, and been debt free in a little over a year at a cost of just £90. A local charity, the Community Law Service in Northampton, is now helping her apply for a debt relief order.

IVAs as a ‘moral’ duty?

During our investigation, “Hannah” was called by a representative from Fortis Insolvency, an IVA provider, who repeatedly said there was a “moral” argument for an IVA, implying that it was morally incumbent on her to pay back more of her debt than she may have been legally obliged to. The Fortis agent also suggested changing her expenditure figures to make it seem as if “Hannah” could afford to enter into an IVA when she couldn’t.

They suggested that if she decided “morally” to pay something back to her creditors and made “cutbacks” to her already tight budget then an IVA could be the right solution. The call handler went on to deduct £31 from her family’s weekly grocery and toiletries budget, which had been calculated at £106. The call handler told her: “On the negative side or the moral side [of a debt relief order] you pay nothing back to your debt and your lenders … It [the IVA] gives you the ability to morally pay something back before receiving a debt write-off.”

Fortis Insolvency told TBIJ that “Hannah” would have had subsequent calls with the company to ensure she was suitable for an IVA before one was put in place. A representative said that the call had been flagged up by a random compliance audit because the term “government scheme” was used and the call handler has since received feedback on this.

The company said it accepts its “processes may not be as slick and efficient as other organisations” but it believed parts of the call had been taken out of context and its systems provide people “plenty of opportunity” to reflect and consider their options. It said: “We take seriously allegations of this nature and strive to provide the best possible advice and options to people facing difficult circumstances.”

TBIJ’s findings are echoed in a new report from Citizens Advice highlighting the problems around IVAs. Analysis of more than 100 reports from Citizens Advice advisers found 45% reported seeing people who had been given misleading information on other debt solutions. In a sector-wide survey of more than 560 debt advisers, 84% said they had seen people in unsuitable or failed IVAs and 72% noted often seeing cases where proper advice had not been given on alternatives.

Diane Carragher, from Liverpool, has multiple sclerosis and is, in her own words, mostly bedbound. After the death of her husband in 2001, she struggled financially and began building up debt to cover essentials such as clothing for her five children.

“The school uniforms were quite expensive, that’s why I started getting catalogues because they needed new shoes or new skirts or whatever. Everything was paid spot on time but then all of a sudden everything started getting to me,” she said.

Last March, she was contacted by a referral company offering ways to clear her debt. By this point she owed thousands of pounds and was being hounded by creditors, while her only income was disability benefits. She said the company hid that extra fees would be added to the IVA and coached her on what to say when contacted by the IVA provider.

“[They said] ‘You’ll be debt free within five or six years and able to live your life again.’ … They made it sound so easy … He said, ‘Say no to everything else but just say yes to an IVA, you don’t want anything else just an IVA.’”

Diane made six £100 payments into the IVA but began struggling to afford it. She needed a new bed to help with her disability and ended up with little spare cash to make the agreed payments. “I was panicking, I was like, ‘God what am I going to do?’ I wasn’t sleeping at all, I just wasn’t sleeping.”

Luckily somebody at her GP surgery recommended she seek independent advice from the Vauxhall Law Centre, which has since helped her end her IVA and apply for a debt relief order.

False ads, fake charity

The advertising for IVAs is pervasive across social media. Many companies have taken to TikTok to reach potential customers, describing IVAs as a good way to get out of debt fast. One example, Debt Help Group Limited, has 179,000 followers and 2.6m likes on the platform. But its videos can be misleading. In one posted in November, John MacDonald, the face of the company, suggests to viewers that they could be debt free by the following month. In another, he walks on a treadmill while a list of the pros and cons of an IVA flash up on the screen. According to the video, an IVA has just one downside.

Responding to TBIJ, MacDonald argued he did not specifically name IVAs. “The description is there on the content but I could go on and describe a 5ft 10 guy with dark hair and blue eyes, that doesn’t necessarily have to be myself,” he said.

MacDonald said he wants his videos to help break the stigma around debt by encouraging more people to come forward for help, and he is working with a compliance company to ensure he is doing everything correctly. However, he acknowledged that both the videos TBIJ highlighted as potentially misleading could have been worded better.

He said: “If you look through the videos, you’ll see, I think you’ll agree, the lives that have been saved, the amount of people whose lives have been changed.”

MacDonald would not tell us what fees he received for referring potential IVA customers.

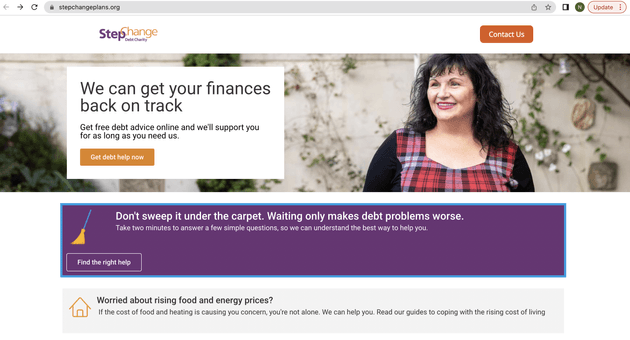

Some ads go beyond the misleading into outright fakery. StepChange, a debt charity that also provides IVAs, said it regularly has to report companies for impersonating the organisation in adverts online. During TBIJ’s investigation, the charity highlighted a clone of its own website that used StepChange’s logo, content, address and charity registration number. Anyone searching for StepChange – which is a leading debt charity that says it offers IVAs only to those who are suitable for them – could instead be sent to this fraudulent website.

The real StepChange website ...

The real StepChange website ...

and the fake clone

and the fake clone

When “Sarah” filled out the contact form on the cloned site, TBIJ received a call within minutes from “John from StepChange, the debt charity”.

He quickly began to sell the idea of an IVA. A follow-up call from a company called Debt Free Life Limited then went into greater detail on the process and said they just needed some documents from “Sarah” before being able to pass her details over to an IVA provider. When asked which companies they refer to, the call handler said they work with “most of the insolvency companies”.

TBIJ asked 10 of the biggest IVA providers in England and Wales if they received referrals from Debt Free Life Limited. Creditfix, The Insolvency Group, McCambridge Duffy, Debt Movement UK and Abbotts Insolvency Limited all said they didn’t, while the rest failed to respond.

Debt Free Life did not respond to a request to comment.

The cloned website has since been taken down, but TBIJ has discovered another, which has been reported to the charity.

TBIJ also came across a Facebook page that appears to be impersonating Citizens Advice. “Citizen Help Desk UK” uses the charity’s name and a similar logo in several of its posts.

TBIJ called the number advertised on the page and were urged by the call handler to send in the relevant documentation needed to put together an IVA application. A follow-up email linked to a website called Money Advice Debt Help and a WhatsApp message were later received requesting the same.

The website Money Advice Debt Help offers “help and advice” on debt solutions and also uses the name Money Advice Ltd (an IVA provider) at the bottom of some of its pages. TBIJ spoke to a director of Money Advice Ltd, who said they had never had dealings with this website and warned the industry has a problem with people impersonating genuine companies and charities.

Money Advice Debt Help has not responded to a request for comment and although the website and Facebook page still exist, the posts appear to have been removed since TBIJ made contact with them.

Ads for IVA-linked companies are also being targeted at people searching for StepChange on Google. TBIJ ran 4,000 Google searches for StepChange across London and Manchester over 12 days and of the top 15 results, after the charity itself, 11 were from either IVA providers or referrers.

A failure of regulation

Part of the reason murky practices have been allowed to continue around IVAs is the lack of comprehensive regulation. Instead, a patchwork of agencies oversee different parts of the process. There’s no watchdog for IVA companies, but the employees who have to oversee cases are regulated by their own professional bodies, one of which is the Insolvency Practitioners Association (IPA).

Then there’s the FCA, which has responsibility for some, but not all the businesses pushing people towards IVA providers. Only the companies that are approved and regulated by the FCA are allowed to give financial advice, but some middlemen operating outside this regulation blur the boundary between advertising debt solutions and offering advice. The distinction can often be unclear to anyone searching for debt help.

Nikhil Rathi, the CEO of the FCA, said at a March meeting of the House of Commons Treasury committee that although the organisation does not “particularly regulate” IVAs, it was taking action to tackle some of the problems. He said: “One of the very disturbing things about what we’ve seen during the pandemic and the subsequent cost of living challenges is the way in which unscrupulous actors particularly pursue vulnerable customers… IVAs are outside our formal perimeter but we do seek to make sure we are doing what we can within the remit we have.”

The IPA told TBIJ: “The number of complaints the IPA receive in relation to IVAs is very low, representing just 0.03% of all IVAs registered nationally. We actively monitor and investigate the sector as part of our regulatory duties and take all breaches extremely seriously. The IPA continues to work with the FCA, Advertising Standards Authority (ASA) and the Insolvency Service to tackle the harms that unregulated debt advertising can have on the ability of a consumer to seek accurate and balanced advice.”

An FCA spokesperson said: “We take allegations of this nature very seriously. We are looking into the information and firms included in the mystery shopper exercise and will take action where we see consumer harm.

“Unsuitable or poor advice can really harm people’s financial lives … A number of large firms have either left the sector or suspended their activities since we first raised this issue. We will continue to take action against those providing poor advice.”

Both the FCA and the Insolvency Service have identified problems with the market, while the ASA has taken some action over misleading ads. The FCA is consulting on proposals to ban referral fees for the IVA referrers it regulates and the government has published proposals to overhaul insolvency regulation.

Citizens Advice, while welcoming the proposed changes, said they would take years to implement. The organisation wants anybody entering into an IVA to first receive full advice from an FCA-regulated firm.

Matthew Upton, director of policy at Citizens Advice, said: “IVAs are meant to provide a solution to problem debt. But far too often, people are being preyed upon by profit-driven firms who are running riot in the market. For people desperately seeking debt help, a flood of inaccurate or misleading advice could push them further into debt and much further away from a lasting solution to their problems.

“The growing number of issues in the IVA market are a hidden scandal that must be addressed. We’re calling for the advice which IVA firms provide to be brought under FCA regulation as a matter of urgency.”

Rimdžienė hopes that telling her story will help prevent more people falling for the false promises of some of these companies. “Now I understand I was so silly but at that point it felt like a breath of fresh air. I felt like it was all going to be sorted but that hasn’t happened,” she said. “Knowing that I could’ve got help a long time ago … that makes me feel like I need to stop other mums signing those things. I realise that these things shouldn’t happen at all. People like me, in those situations, we can find a solution, we can find help, we can find support.”

Need help?

Free debt advice is available from: Citizens Advice | StepChange | National Debtline

Header image: Anastasija Rimdžienė at her home. Credit: Gavin Wallace

Reporter: Natalie Bloomer

Data analysis and checking: Charles Boutaud

Additional reporting: Priyanjana Bengani

Bureau Local Editor: Emily Wilson

Editor: Meirion Jones

Production: Frankie Goodway and Emily Goddard

Fact Checker: Niamh McIntyre

Photography: Gavin Wallace