Vodafone: Undercover investigation exposes Swiss branches

Vodafone’s accounts suggest it attributes billions of pounds in profit to branches in the tax haven of Switzerland – but an undercover investigation indicates hardly any business is done there.

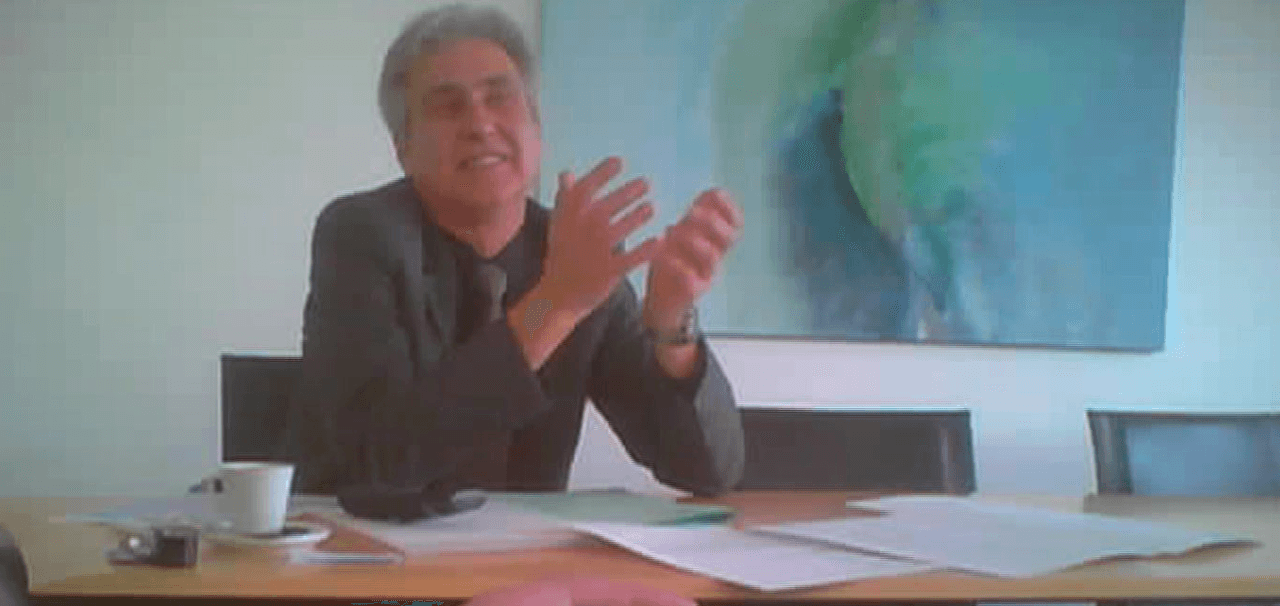

An undercover operation by the Bureau of Investigative Journalism and Private Eye has revealed that Vodafone’s Swiss branches are run by a single part-time bookkeeper, indicating their main purpose is tax avoidance.

In a meeting with reporters posing as consultants, Vodafone’s Swiss branch manager revealed that:

• He is primarily a bookkeeper;

• Vodafone takes up less than 5% of his time;

• He is not involved in decision-making but follows orders from Vodafone’s Luxembourg office;

• Vodafone has a dedicated room in his office but it is almost always unoccupied.

The revelations suggest the Swiss set-up is artificial and should not escape greater scrutiny from the British taxman. They also call into question HMRC’s agreement in 2010 that the Swiss branch structure could continue untaxed in future.

Click here to see the Bureau’s film.

A common, legal tax avoidance technique used by companies based in Luxembourg is to attribute profit to a Swiss branch. Luxembourg authorities exempt the profits while the Swiss taxman applies a relatively trivial amount.

Vodafone – which has its headquarters in the UK – publishes a single, combined set of accounts for its Luxembourg subsidiaries and their Swiss branches. The accounts show that for one company, profits worth $2.5bn (£1.6bn) were taxed at less than 1% in 2011. The profits are likely to have been attributed to Switzerland.

The Bureau and Private Eye visited the country to investigate whether any real business was being done there.

Journalists posed as consultants with clients hoping to set up Swiss branches and were invited to a meeting with accountant Peter Graf on February 21, 2012. Graf is a Vodafone employee based in an accountancy firm in Bern, who manages several Swiss branches of Vodafone’s Luxembourg subsidiaries.

The European Court of Justice said in 2006 that anti-avoidance laws could kick in when schemes are ‘wholly artificially arrangements which do not reflect economic reality, with a view to escaping the tax normally due’. Yet in 2010, when HMRC settled a tax dispute with Vodafone over the Luxembourg-Swiss structure, it agreed that British anti-avoidance laws, known as the controlled foreign company (CFC) rules, would not apply from that point onwards.

Vodafone said at the time that ‘due to the facts established in this agreement’, amendments to the CFC rules coming into force in 2012 would not generate a tax bill either.

In response to the investigation’s findings, Vodafone said it does not claim to have ‘material activities or operations in Switzerland’, that Vodafone’s structure is totally transparent, and that the existence of the Swiss branches was examined by HMRC before reaching the settlement in 2010. Its full response is here.

But the company refused to respond to questions on how it allocates its profits between Switzerland and Luxembourg, and why it maintains a Swiss bookkeeping office when it has so few business activities there.

An HMRC spokesman said: ‘HMRC cannot comment on Vodafone’s business arrangements, nor on how any such arrangements may be affected by the new controlled foreign company rules to be introduced in Finance Bill 2012.’

Main image taken from video of Vodafone’s Swiss branch manager talking to undercover reporters