Binary options fraud finally banned

...and leading Binary Options trader indicted

The EU today banned binary options fraudsters from targeting individuals in Europe. This comes just days after Lee Elbaz, a woman whom the Bureau accused of being a leading figure in the scam, was indicted for fraud in Maryland USA. The binary options “boiler room” operations are thought to have cost people in dozens of countries many billions of dollars over the last few years.

The fraud involves phoning potential clients and pressuring them to “invest” in binary options, which are effectively bets on whether the price of a product, such as oil, or a share price will go up or down in value. The target can access their account online and can see that they appear to be doing very well. They are persuaded to put in more and more money as their virtual account keeps climbing in value but when they try to take it out most of the binary option companies refuse to pay out.

Some of the people to whom the Bureau talked had lost their life savings, sometimes amounting to hundreds of thousands of pounds. Others are reported to have committed suicide when they realised they would never get their money back.

The Bureau newsletter

Subscribe to the Bureau newsletter, and hear when our next story breaks.

Some binary options companies sponsored Premiership football clubs to promote the names of their companies and manipulated newspapers into running puff pieces promoting their operations to the readers. They cleverly used social media - with thousands of fake followers - to give the impression that there was an army of investors who had got rich quick by investing in Binary Options.

In 2016 a whistleblower came to the Bureau and revealed the criminal way in which some companies - mainly based in Israel at the time - operate. When they are targeting British clients they use fake British phone numbers and City of London addresses and claim to be properly regulated. Our whistleblower provided the Bureau with lists of hundreds of British victims who confirmed that they had been defrauded, as well as others from all over the world, and we ran a series of articles detailing malpractice by Binary Options traders.

Got a Story?

We welcome tip-offs from the public and we always protect our sources

Find out how to work with usMany European countries took prompt action to clamp down but Britain did nothing. The police told the Bureau that it was the biggest fraud hitting individual British people but they did not have the powers to deal with it because the fraudsters were based abroad. The UK only took action in January 2018 when it made the Financial Conduct Authority responsible for binary options regulation.

On March 27 2018 the European Securities and Markets Authority (ESMA) barred binary options companies from selling to individuals and the UK’s Financial Conduct Authority said it “supports ESMA’s application of EU-wide temporary product intervention measures”.

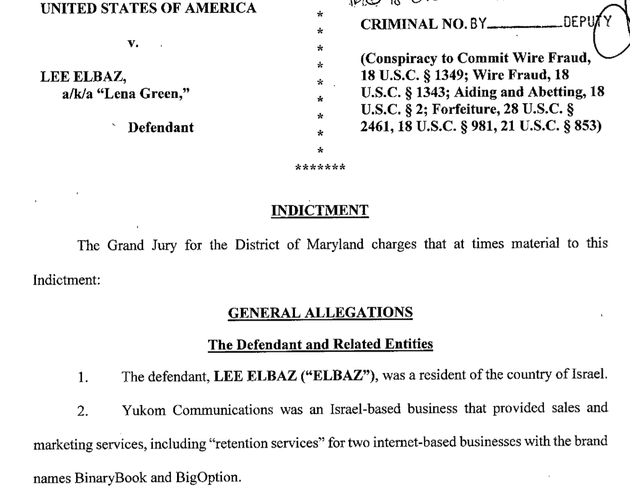

In November 2016 the Bureau named Lee Elbaz, Yukom, Binary Book and Big Option as key players. The companies threatened legal action to try to prevent the Bureau publishing but did not, in the event, sue after publication. Last year Lee Elbaz made the mistake of making a stopover in the USA and was arrested. On March 22 2018 Elbaz was indicted with Yukom, Binary Book and Big Option named in the indictment.

Indictment of Lee Elbaz AKA "Lena Green"

Indictment of Lee Elbaz AKA "Lena Green"

The indictment states that Lee Elbaz AKA “Lena Green” was Chief Executive Officer of Yukom, which provided services for Big Option and Binary Book and that she described herself as Trading Floor Manager for those two companies. It alleges that between about May 2014 and June 2017 Elbaz knowingly conspired with others "to defraud binary options investors...by means of materially false and fraudulent pretences".