'Unprecedented risk': Thurrock finance chief ignored warnings about catastrophic deals

The chief finance officer of a council facing the largest budget gap ever reported by a UK local authority ignored multiple warnings about the “unprecedented” risks he was taking with public money.

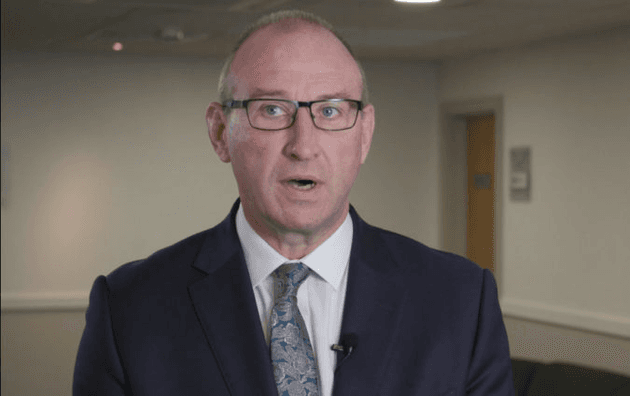

Sean Clark, corporate director of resources at Thurrock council, arranged a series of failed business deals that has left the local authority with a funding gap of £470m – more than three times its annual budget.

In a budget report published on Tuesday, the Conservative-run council admitted £275m of taxpayers’ money will be lost as a direct result of investments it has made.

Evidence obtained by the Bureau of Investigative Journalism suggests Clark failed to act after being cautioned about the haste, risk and scale of his investments, and about specific deals he was making.

John Kent, leader of the Labour group on the council, said the allegations were “deeply disturbing”.

In March 2018, the financial consultancy Arlingclose wrote to Clark personally to express urgent concern about the council’s “extreme” appetite for risk that the company felt was “well beyond” all of its other clients, even those who had adopted aggressive approaches.

The strategy of investing huge sums of money borrowed from other local authorities had, wrote Arlingclose, moved the council “well beyond the tolerances of what we consider to be prudential risk-management boundaries”.

The letter listed a series of risk areas including the £370m invested in unrated bonds, high levels of debt and “huge exposure” to local authority funding. It also noted that the company’s “advice has either been ignored or we simply have not been consulted”.

The letter continued: “Arlingclose currently works with several local authorities that have pushed the investment boundaries … but the extent of the risk taken by Thurrock council without consultation with us in key decisions is unprecedented.

“This activity presents reputational issues, both for Thurrock council and Arlingclose.”

Sean Clark continued to arrange deals for more than a year after Thurrock decided to pause its investment policy.

Sean Clark continued to arrange deals for more than a year after Thurrock decided to pause its investment policy.

An internal council report into Clark’s conduct, leaked to the Bureau, alleges that he failed to act on this advice or pass the concerns on to other senior figures at the council. This “contributed to the council’s financial failures and the resulting government intervention”, said the report.

Clark terminated the council’s relationship with Arlingclose in March 2019 and continued to approve increased borrowing from other local authorities, which at one stage were owed £1bn by Thurrock, in order to finance investments.

Those deals include much of the £655m provided to companies owned by the businessman Liam Kavanagh, via bonds that financed the purchase of 53 solar farms. Earlier this month Kavanagh’s company, Toucan Energy Holdings 1, was put into administration and this week the council admitted it has lost £188m as a result.

In a statement, Kavanagh said: “I installed a new management team in June 2022 and, as far as I am aware, the underlying business has traded strongly and all interest has been paid in full and on time in accordance with the terms agreed between Thurrock council and the company.”

He said that, if approached, he would “assist the administrator to achieve the best outcome for the company's stakeholders”.

Arlingclose was not the only outside organisation to have raised serious concerns with Clark about the deals he was making.

In late 2018 the council started to significantly increase its investment in a portfolio of 32 solar farms. These top-ups were agreed after undisclosed meetings between Kavanagh and Clark, with the basis for the investment being a report commissioned by Kavanagh’s company that claimed the sites had gone up significantly in value since they were bought with the help of the council less than a year earlier.

There is no evidence of any due diligence being undertaken by the council to independently verify the increased valuation. These payments would eventually total nearly £140m and the council has little idea where the money ended up.

The report into Clark’s conduct reveals the top-ups were made in three stages and alleges that, before the third payment was made in early 2020, the legal firm Bevan Brittan “flagged serious risks with the investment to [Clark]” only for the deal to be “authorised before these matters were resolved”.

A spokesman for Bevan Brittan said it would not be appropriate for the firm to comment.

It is also alleged Clark continued to invest tens of millions of pounds after councillors agreed no further deals should be made, including to a company that has since gone bust.

In September 2020 the council decided to pause its investment policy. Yet Clark continued to arrange investments for more than a year. The report lists nine transactions totalling nearly £55m between October 2020 and December 2021, which it describes as “a serious breach of delegated authority”.

Those investments include some of the £94m Thurrock has tied up in Just Loans Group PLC, a lender which provides funding to businesses unable to raise money through traditional means. The company went bust in June and the council estimates it will lose £65m.

Other failed investments include £19m lost in a deal with a company that supplies eco-friendly generators to leisure centres and £14m written off after the collapse of a wood-chipping business Chip Chip Ltd.

The leaked report says there was “no evidence to show appropriate due diligence was undertaken” by Clark before the investments took place, adding that “the quality of governance in place for a £1bn investment programme was inadequate and the scale of delegated authority was too great”.

A separate report, published by the council on Tuesday, revealed Thurrock has never set aside any of its budget to repay the loans that financed its investments. The report said this was in breach of the rules around local government borrowing and represented a “material failure that has led to the significant overspend”.

The council is obliged to rectify this and apply the appropriate charges. The cost of doing so will be £129m this financial year and £75m the next. It was Clark’s responsibility as chief finance officer to make sure these regulations were followed.

It was also Clark’s role to decide whether to release details about the investments in response to FOI requests. After a three-year battle, in October this year a tribunal ordered the council to disclose this data to the Bureau. Its ruling criticised Clark for his “worryingly casual attitude” towards keeping councillors informed of what he was doing.

A spokesperson for Thurrock council said it does not comment publicly on internal employment matters. Its statutory financial powers have been handed to commissioners from Essex county council, which is also undertaking an inspection which will report to the government in January.

Clark did not respond to requests for comment. He has been suspended on full pay since the urgent government intervention in September following “grave concerns about the exceptional level of financial risk and debt incurred by the council”. The council’s debt currently stands at £1.4bn – almost twice the level that alarmed Arlingclose.

In October 2019, Clark did admit to wondering whether the council’s borrowing and investments had gone too far. “I have an internal conversation on this,” he said. “Sometimes I look at it and go, ‘We’ve done an awful lot here. Should I have done that amount? Should we be doing this?’

“But then I come back and go, ‘Actually, local authorities have always done this.’ All we’ve done is upped the amounts we’re talking about.”

Header image: Council housing in Thurrock. Credit: Alex Sturrock for TBIJ

Reporter: Gareth Davies

Bureau Local editor: Emily Wilson

Editor: Meirion Jones

Production editor: Alex Hess

Fact checker: Jasper Jackson

Our reporting on local power is part of our Bureau Local project, which has many funders. None of our funders have any influence over our editorial decisions or output.

-

Subject:

-

Area: