UK: One short-term lender for every seven banks on the high street

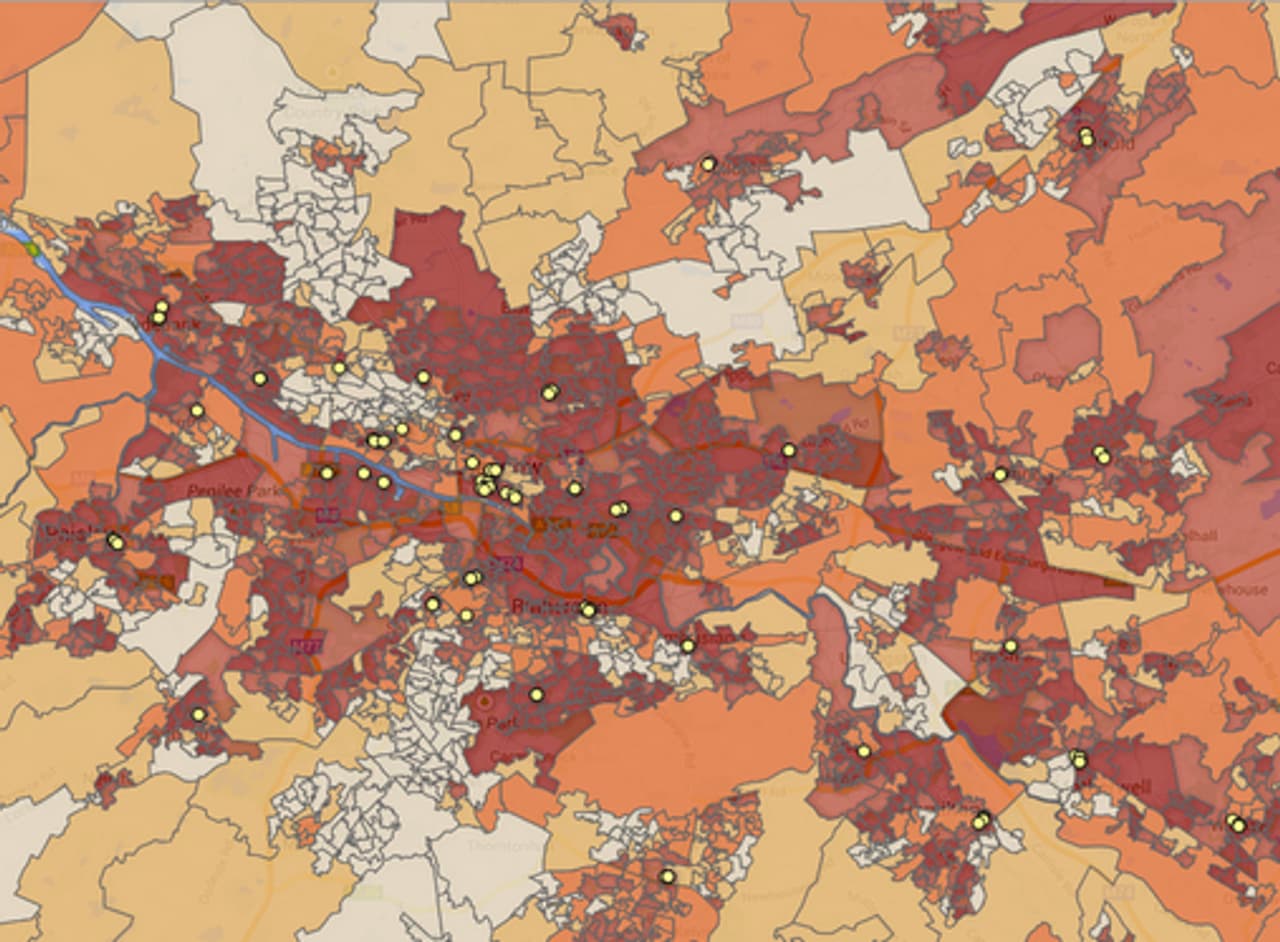

Above: an interactive map showing stores that offer short-term high cost credit across the UK

Data collected by the Bureau of Investigative Journalism reveals there is now one short-term loans store for every seven banks or building societies on the high street.

In total the main short-term lenders run 1,427 shops in England, Scotland and Wales. In August last year a report from the University of Nottingham found that there were 10,348 bank or building society branches in these countries.

There are also a further 49 short-term lending shops in Northern Ireland.

The Bureau’s investigation is the first time all the stores operated by the biggest suppliers of short-term credit on the nation’s high streets have been mapped. Previous measures of the proliferation of lending shops have relied on local surveys.

In particular, the Bureau measured the rate of stores per 100,000 residents for local authorities across the UK. The resulting maps showed lending shops are disproportionately located in impoverished communities.

Campaigners have previously expressed concerns about the spread of short-term credit in deprived areas, likening the situation to the clustering of gambling shops.

– Paul Blomfield, MP for Sheffield

Paul Blomfield, MP for Sheffield and a leading anti-payday campaigner said: ‘These shocking figures show the scale of the payday lending epidemic on our high streets. Their corrosive impact is then often exacerbated by the companies clustering their shops in areas of higher deprivation. Councils need new planning powers to be able to restrict the number of shops in their area, and this would allow local residents to have their say on what shops can and can’t open up.’

The Bureau’s data does not include the hundreds of smaller and independent operations. We have concentrated on the seven largest national chains and only included their branches that offer short term loans of one year or less. In the case of national pawnbroking companies we have only included those branches thatoffer loans.

Lewisham: UK capital of short term credit

The Bureau measured the rate of loan stores per 100,000 people for local authorities across the UK to show the areas with the highest concentration of lenders. The results reveal that stores are disproportionately located in areas of poverty.

Lewisham in south-east London has the highest rate of stores to residents in the UK, with 7.6 stores for every 100,000 residents.

The borough was ranked as the 16th most deprived local authority in England by the Department for Communities and Local Government (DCLG), which found Lewisham contained some of the most impoverished communities in the country.

– Mike Harris, Labour councillor for Lewisham

Mike Harris, a Labour councillor for Lewisham said: “Many residents have raised concerns with me over the number of stores and their marketing methods. During the Olympic torch relay in Lewisham, one loan firm dressed up in costume to hand out flyers promoting high interest loans to local parents. Loan firms will flyer council estates where they know people are struggling due to the cuts in benefits. Our local credit union does fantastic work but is out-gunned by the huge advertising machine behind the payday loan companies.”

Lewisham was not the only London borough to feature highly in our rankings. In total three London councils are in the top ten local authorities in terms of stores per 100,000 residents, including Hammersmith and Fulham and Barking and Dagenham, which is the eighth most deprived borough in London.

Situated in West London, Hammersmith and Fulham contains an extensive retail area, where loan stores have clustered. Though Fulham in the south of the borough is affluent, areas to the north and west of the local authority suffer from deprivation. In all the district is ranked the 31st most deprived borough in the UK.

Halton, a borough on the Mersey estuary to the east of Liverpool has the third highest number of stores per person in the Bureau’s research, with just over seven stores for every 100,000 residents. The borough is the 32nd most deprived local authority in the England.

Nearby Liverpool – which the Department for Communities and Local Government (DCLG) found was the fifth most deprived local authority in the UK – comes 12th in the ranking of stores per 100,000 residents. In total the city council has 26 short-term loan shops within its borders.

Table showing local authorities with highest rates of short term loans stores per 100,000 residents

Glasgow has the most short-term loans stores in the country

Glasgow City Council has the highest number of stores offering short-term credit, with a total of 40 stores. In terms of density of payday stores per number of residents the city is the fifth highest ranked area in Britain, with 6.7 stores for every 100,000 residents.

It was not the only council in the Glasgow metropolitan area to feature highly in our rankings.

Situated on the Clyde Estuary to the west of Glasgow, West Dunbartonshire and Inverclyde were also ranked in the top ten for the number of stores per head of population. A recent economic profile by West Dunbartonshire Council stated that 26% of children in the local authority were growing up in poverty and that 23.8% of residents derive some or all of their income from welfare support, compared to a UK average of 14.8%.

Lending shops cluster in deprived areas

We have superimposed the locations of loan stores onto maps showing deprivation and this shows how lending shops are clustered in more impoverished areas.

For example, in the image below the areas in blue are affluent compared to those in orange or red – which is where the lending shops have clustered.

Above: A map showing stores in England superimposed onto deprivation – the darker areas are more deprived. Click on the image to explore the map.

Councils turn to planning law to slow spread of payday lending

Many councillors across the country have grown increasingly concerned about the rapid spread of stores offering payday loans and short-term lending. As these shops do not have a distinct planning class of their own it has previously proved difficult for councils to control the spread of high-cost lending stores.

They are turning to powers – known as an Article 4 Direction – normally used for heritage conservation, when a council believes a development will have a negative effect on an area. Normally, no planning permission is needed when a property is used for the same business, so banks can become loan shops because they are both in the same planning class – in this case, financial services. But councils can challenge a change of use when it is between planning classes by using an Article 4 Direction. As such councils hope to prevent retail shops, pubs and restaurants from being converted to high-cost credit stores.

In July Islington Council in London announced an Article 4 Direction to prevent more payday loan stores and betting shops being established in properties that formerly housed shops, pubs and other businesses. This will come into effect in July 2014. Southwark Council in south London announced in October that it would also implement planning controls to stop more lending shops opening in the borough.

Additional reporting: George Arnett

Below: A table showing Local Authorities and concentration of loan shops. Click on the table to get the data.